How To Get Involved In Decentralized Finance (DeFi) And Start Earning 15%+ APY From USD

Initially, I wanted to write an article explaining to people how they could currently earn 15%+ annual yield on their USD with crypto in a low-risk way… but then I realized that majority of people are only familiar with buying and selling crypto through apps like Coinbase, Robinhood, and Shakepay and not with using their crypto to interact with the Decentralized Finance (DeFi) world.

So the goal of this article is to show you how to do this in the simplest and easiest way possible so you can start doing things like earning 15%+ annual yield from your USD. If at any point you have questions, just message me on Twitter (https://twitter.com/ZainManji).

The crypto ecosystem is extremely exciting right now. Everyday, there is something new that arises or a big improvement in the ecosystem that makes it really hard to keep up. But because there is so much foundational innovation happening behind the scenes, the UX and the way majority of individuals interact with crypto is complicated. This is okay for now… it just means that if you want to be more involved in this space and interact with the DeFi world, a little more education is needed. So hopefully this article gives you that extra education to gain more of an edge.

Okay, what’s on the agenda…

- How to buy crypto with your USD through a centralized exchange (e.g. Coinbase)

- Why keeping your crypto on a centralized exchange is okay initially, but not recommended

- What to do because of these centralized exchange problems — the hardware wallet solution

- How can you move your Bitcoin and Ethereum to your hardware wallet

- What DeFi is and how to enter the world of DeFi with your hardware wallet

- DeFi example: How to buy $DPI (DeFi Pulse Index) — step by step

How to buy crypto with your USD through a centralized exchange

Let’s assume you don’t have any crypto at the moment, and all you have is USD in your bank account. And for simplicity purposes, let’s say you want to buy some Bitcoin and some Ethereum. (Note, you’ll want to purchase Ethereum as Ethereum is needed in order to enter the DeFi world as explained later in the article).

Currently, the easiest way to buy some Bitcoin and Ethereum is through a centralized exchange like Coinbase, Binance, or Shakepay. Majority of people purchase their crypto this way because you can directly link your bank account to the app and because the UI/UX of the apps are easy to understand and navigate.

Steps to purchase your crypto (Coinbase example):

- Download the Coinbase app from the iOS/Android app store.

- Sign up for an account. When signing up, you will need to provide identity information and link the app to your bank account (e.g. Chase, Bank of America, TD, RBC, etc). Identity is needed for KYC compliance (KYC == “Know Your Customer”) as Coinbase needs to know who is buying/selling what in order to abide by compliance rules.

- After signing up for an account and getting approved, you can start purchasing crypto. (Note, your account will have a weekly approved spend limit which is an upper limit of $$$ you can spend from your bank account to purchase crypto).

- Now to purchase crypto with USD from your bank account, tap the “trade” button, select “buy crypto with cash”, select which asset you want to buy (i.e. Bitcoin and Ethereum), how much you want to buy, and tap purchase.

- After a successful purchase, you should see that your portfolio now contains the crypto you bought.

Congrats! You have just purchased crypto with your USD from Coinbase. What happened behind the scenes was you just paid Coinbase $X (plus a fee) for them to purchase Bitcoin and Ethereum on your behalf and hold it (i.e. custody it) for you. Now Coinbase is your bank for crypto.

Why centralized exchanges are okay initially, but not recommended

Your Bitcoin and Ethereum is now sitting in your Coinbase account, you’re watching your portfolio price move up and down, and you feel alive. But what if I told you that keeping your crypto in your Coinbase account was not recommended?

Here’s some reasons why…

1. Not your keys, not your coins

There’s a famous phrase that people in crypto always say, and it’s “not your keys, not your coins”. This is a super important phrase because it refers to the fact that if you don’t have control over your crypto (via their private keys) then you aren’t truly in control over what you can do with your crypto — you need to ask for permission to use it. Ledger academy has a great article on this.

Since your Bitcoin and Ethereum is being held in Coinbase, Coinbase is in control of them and decides what you can and cannot do with them. You need to ask Coinbase for permission to use your Bitcoin and Ethereum.

For example…

- Coinbase decides how much crypto you can buy and sell per week and when you can buy and sell. There has been many situations where people wanted to buy or sell crypto on Coinbase and couldn’t because their weekly “spend” limit had already been met.

- When Coinbase goes “down for maintenance”, which they often do in times of high volume, they will not let you do anything with your crypto (e.g. buy, sell, or transfer).

- If one day you want to spend your crypto, Coinbase could reject you for some obscure reason and then you’d be stuck.

2. Trusting the centralized exchange to keep your crypto secure

Since your Bitcoin and Ethereum is held in Coinbase, you are trusting Coinbase for their security — if they get hacked, get shut down, or get in trouble, you could lose all your coins. This has happened to a few centralized exchanges already. One example was Quadriga where all their customers were unable to access their crypto due to fraud committed by the Quadriga co-founder. Here’s a good story on it by Vanity Fair. For what it’s worth, Coinbase is one of the most trusted centralized exchanges in the ecosystem.

3. Being restricted to tokens only listed in the exchange

Coinbase currently has over 25 tradable tokens listed on their exchange (see here), but are missing a number of tokens. In order for a token to get listed on Coinbase’s exchange, Coinbase and their team internally reviews that token, and if approved, then makes it accessible to Coinbase users and allows them to buy or sell that token. Now, let’s say there was a token that you really wanted to buy or sell (for example $DPI) that is not listed on Coinbase, you’d be out of luck — no buying/selling $DPI for you.

4. Inability to interact with DeFi apps/protocols.

More on this later, but let’s say you wanted to get a little fancy, and “lend” out your ETH in order to earn some interest on it (just like how you currently lend out your USD to earn interest on it) via a DeFi protocol like Compound. You can’t do that from your Coinbase account since Coinbase doesn’t have a “Compound integration”. You’d need to wait for Coinbase to build that functionality in their app in order for you to interact with it.

What do people do because of these centralized exchange problems? What’s the recommended solution?

The above four problems are true for any centralized exchange, so what people do to solve this is they move their crypto from Coinbase to their own hardware wallet.

What is a hardware wallet?

A hardware wallet is a physical device designed to securely store your crypto (private keys). You can think of a hardware wallet as a USB stick that holds your coins. It’s considered safer than desktop or smartphone wallets, mainly because they don’t connect to the Internet at any point.

How does a hardware wallet solve the 4 problems mentioned above?

- When your Bitcoin and Ethereum is in your hardware wallet, you can do whatever you want with it, whenever you want. This is because now you are in control of your private keys now, not Coinbase. Coinbase doesn’t control your crypto now. You can now buy, sell, or transfer your crypto from/to whomever you’d like, whenever you want. It’s the same as if you had cash in your actual wallet — you are in control of your cash. The main thing here is that you don’t need to ask anyone for permission when it comes to your crypto. You are in complete control now.

- A hardware wallet is much more secure. When you hold your crypto in your hardware wallet, instead of on Coinbase, you’re no longer trusting Coinbase with your crypto’s security. You are now your own bank and are responsible for your crypto’s security. The only way you get hacked with a hardware wallet is if someone physically steals your wallet from you and knows your pin/2-factor information. With Coinbase, you can fall victim to data privacy leaks, internet scams like phishing, and more.

- With a hardware wallet, you can hold any type of token you’d like — you’re not limited to just the tokens that are listed and approved on exchanges like Coinbase. If a new token comes into existence and you are bullish on it and want to buy it, you can do so and hold it in your hard wallet (more on this later).

- With a hardware wallet, using any any DeFi protocol/app is easy. You simply connect your hardware wallet to your computer via USB port, then connect your wallet to MetaMask (more on MetaMask later), and then connect to the protocol/app via MetaMask. Okay it doesn’t sound easy, but trust me, after the first time you do it, it’s easy. Now you have the freedom to interact with DeFi apps however you want (more on this later). No need to wait for Coinbase or another centralized exchange to build the tech to integrate with those protocols in order to use them.

How do you move your Bitcoin and Ethereum from Coinbase to your hardware wallet?

Okay, we’ve now decided that we want to move our Bitcoin and Ethereum from Coinbase to your hardware wallet, here’s what you need to do:

1. Purchase a hardware wallet (either a Trezor or Ledger). You don’t need the most expensive model, you’ll be fine with one of their low-cost options.

2. Set up your hardware wallet by following the instructions included when you receive your Trezor or Ledger. Make sure you have a Bitcoin address/account and an Ethereum address/account created inside your hardware wallet.

Inside your hardware wallet you need to set up internal accounts/address that hold your cryptocurrencies and tokens built on top of specific crypto blockchains. For example, your Bitcoin account will hold your Bitcoin, and your Ethereum account will hold not only your Ethereum but also all tokens that are built on the Ethereum blockchain (like $DPI).

3. Find your Bitcoin public address from your hardware wallet (usually by navigating to the Bitcoin account and tapping “receive”), copy the Bitcoin public address, go to Coinbase and send your Bitcoin from Coinbase to that public address.

4. Find your Ethereum public address from your hardware wallet (usually by navigating to the Ethereum account and tapping “receive”), copy it, go to Coinbase and send your Ethereum from Coinbase to that public address.

5. Now if you look inside of your Ledger or Trezor app, you can see your crypto inside of it.

Pro tip:

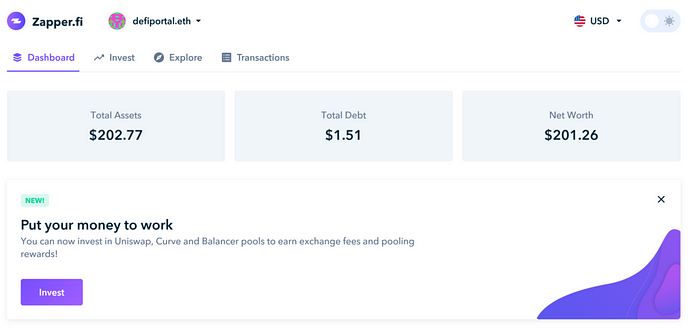

Instead of using the Ledger or Trezor app to view your current crypto holdings on your hardware wallet, I like to use Zapper. It’s a simple dashboard for DeFi, where you can easily track and visualize all your DeFi assets and liabilities in one simple interface. All you need to do is connect to Zapper via your MetaMask and Zapper will watch the public address of your Ethereum address and will show you everything in that address.

What is DeFi?

We’ve been talking about DeFi here and there, but never really explained it yet. Decentralized finance (DeFi) is a world of financial services with no central authority. It involves taking traditional elements of the financial system and replacing the middleman with a smart contract. It can also be described as the merger between traditional banking services with blockchain technology. As of today, April 25 2021, there’s over $55B of USD locked into and circulating inside DeFi apps!

An example of a DeFi service is decentralized loans. The current, centralized way to receive a loan is that you usually have to go to a bank, fill out an application, and then have that bank determine if you’re eligible to receive a loan and how much of a loan you can take. The problem with this is that the process can be long, time consuming, unfair, unequal, and costly. But in a decentralized world, you could cut out the middleman directly (in this case the bank) and get a loan in an unbiased way that is purely based on factors such as how much crypto assets you own.

For DeFi services/apps to be possible, they need to be run on a decentralized infrastructure. Most DeFi apps are currently built on top of Ethereum, and in order to perform “actions” within the DeFi app you need to use/spend ETH (“gas”) in order to pay the Ethereum network fees. More about “gas” in a later article, but this is why ETH is so important and why it’s recommended to purchase at the beginning. Because in order to use any of the DeFi apps built on top of Ethereum, you need to spend ETH.

How to enter the world of DeFi (Hardware wallet -> MetaMask -> DeFi protocols)

I lightly touched on this earlier, but once you have Ethereum in your hardware wallet the process of interacting with DeFi protocols/apps becomes pretty simple.

In short, all you need to do is connect your hardware wallet to your computer via USB port, then connect your wallet to MetaMask, then connect to the protocol/app via MetaMask, and then you can do whatever you want on that app.

What’s MetaMask?

MetaMask is an Ethereum wallet in your browser. It’s a Google Chrome extension that lets you access decentralized apps in your browser. It does this by injecting the Ethereum web3 API into every website’s javascript context so that these decentralized apps can read from the blockchain. MetaMask also lets users create and manage their identities online (via private keys and hardware wallets like Trezor and Ledger) so that when a decentralized app wants to perform a transaction and write to the blockchain, you get a secure interface to review the transaction before approving or rejecting it.

Almost every decentralized app has a button on their website that lets you connect to their protocol via MetaMask.

So make sure you download MetaMask for your Google Chrome browser here: https://chrome.google.com/webstore/detail/metamask/nkbihfbeogaeaoehlefnkodbefgpgknn?hl=en

How to buy $DPI (DeFi Pulse Index) — step by step

The best way to grasp all of this is through an example. In this example, we’re going to buy some $DPI with some of the Ethereum in your wallet. For context, $DPI (the DeFi Pulse Index) is a capitalization-weighted index that tracks the performance of decentralized financial assets across the market. It currently is a weighted basket of 14 top DeFi tokens. You can think of it as the S&P500 but for DeFi. It’s awesome.

So to buy some $DPI…

1. Connect your hardware wallet to your computer (via USB) and unlock your hardware wallet

2. Click on the MetaMask Chrome extension and “Connect Hardware Wallet”

3. The best place to buy $DPI is through Matcha, which is a decentralized exchange. In the DeFi world there are a number of decentralized exchanges that let users buy any type of token that exists in the ecosystem and which has liquidity for, but Matcha is especially good because it helps you find the best prices across exchanges and also lets you purchase and sell tokens in the most cost efficient way. But more on Matcha in another article, all you need to know is Matcha is the best place to purchase your tokens.

So go to Matcha and connect your wallet via MetaMask and search for “DPI”

4. Once you’ve found $DPI, you should see a page like the image above. Here you want to specify that you want to pay $ETH (Ethereum) and receive $DPI.

5. Specify how much $ETH you want to pay or how much $DPI you want to receive, and when you’re ready, click on “Review Order”.

6. After clicking “Review Order”, you’ll first see a screen asking you to “Approve my ETH”. This first level of approval is needed for security purposes as it lets you confirm that you’re allowing Matcha to trade your ETH on your behalf. It will look like the image below, but instead of $DPI it will say $ETH.

7. After clicking “Approve my ETH”, your MetaMask Chrome extension will pop up first asking you if you would like to allow Matcha to access your ETH. It will look similar to the image below but instead of Uniswap it will say Matcha and instead of $DAI it will say $ETH. (Sorry for these weak images, I got lazy…). To approve this, first click the “Edit” button next to “Transaction fee” and change the gas speed to “fast”, so that the transaction can be processed immediately. Then click “Confirm” and then “Approve”.

8. After you clicked “Approve”, you’ll be asked to confirm the transaction on your Trezor or Ledger. This is another security step so you can actually confirm the transaction on your hardware wallet. So go ahead and do that.

9. Next, you’ll get to review your total order. You’ll get to see how much you’ll pay (including estimated gas fees). When ready, click “Place Order”.

10. After clicking “Place Order”, MetaMask will pop up again asking you to confirm the transaction. Again, adjust the Transaction fee to “fast” and then approve when ready. After approving on MetaMask, you’ll be asked to again confirm the transaction on your hardware wallet.

11. Done! Finally! You should now be able to see your new $DPI on Zapper and your wallet 😊

Yes, there are a lot of steps to enter the DeFi world, especially when it comes to approving all of these transactions. But as mentioned before, rapid innovation comes with its laggards. In this case, UX suffers but over time it will improve.

That’s it! You’ve now entered the DeFi world in a very small way.

Congrats, you’ve now purchased crypto from Coinbase, moved it to your hardware wallet, and purchased some $DPI through Matcha. This is just the beginning for you. There’s so much you can do now that you have the foundation and basics down!

In my next article, I will describe how you can lend out your $ETH on Compound and use it as collateral so that you can borrow $USDC against it, and then use that $USDC to enter a liquidity pool to farm some other tokens, and earn 15%+ yield on your borrowed $USDC in a low-risk way.

If you have any questions throughout, feel free to send me a message through Twitter: www.twitter.com/ZainManji 👋

Please share with anyone you feel may find value from it as well 🤗